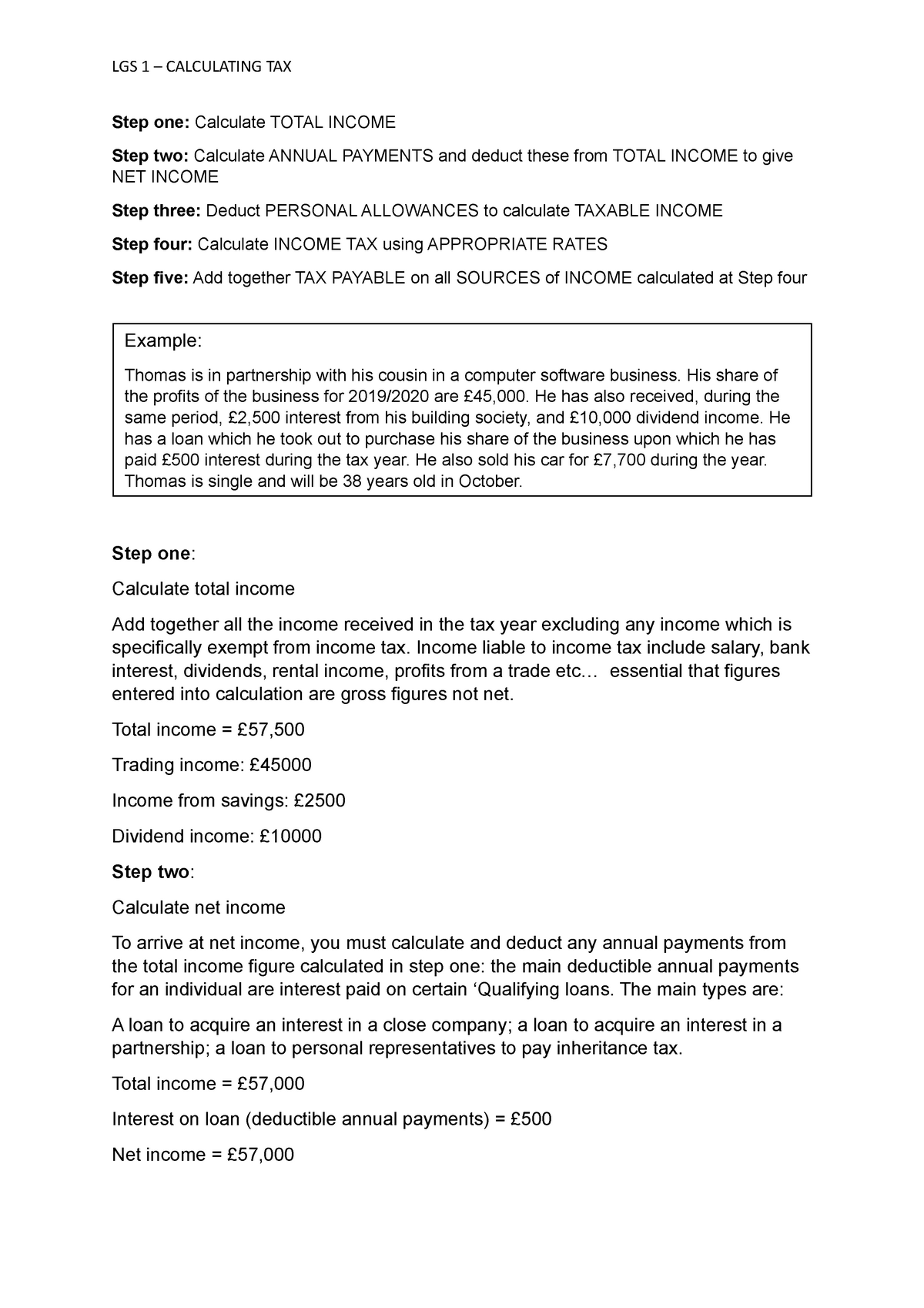

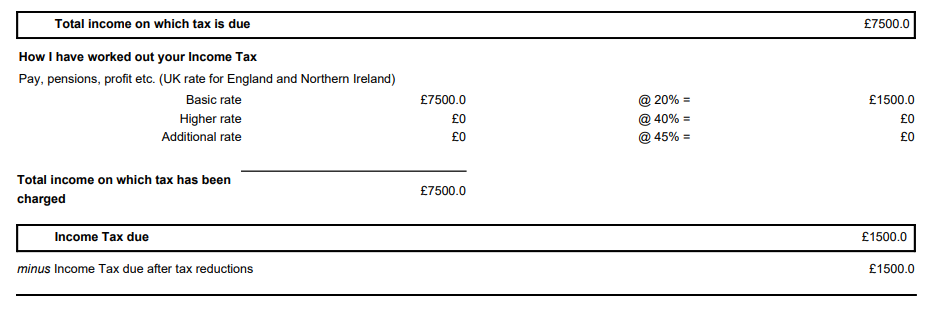

Tax Calculation Example Print - Step one: Calculate TOTAL INCOME Step two: Calculate ANNUAL PAYMENTS - Studocu

UK Tax Rates, Thresholds and Allowances for Self-Employed People and Employers in 2024/25 and 2023/24 | The Accountancy Partnership

Personal Tax- Non-Resident with Excluded income (Disregarded), Double Taxation and Personal Allowance | Knowledge Base

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

.JPG)